On June 28, 2017, the Governmental Accounting Standards Board (GASB) issued Statement No. 87, Leases. This statement established a single approach to accounting for leases where all leases are recognized by lessees on their balance sheet through a lease asset and corresponding lease liability, including today’s operating leases.

Currently, lessee entities are required to recognize capital leases with an asset and liability on the balance sheet and only disclose future obligations resulting from operating leases. Lessees aren’t the only ones who may face significant changes in their accounting for their leases, however. The new standard also modifies a lessor’s accounting for leases to align with the new lessee accounting.

This statement brings US generally accepted accounting standards for state and local governments into general alignment with the Financial Accounting Standard Board’s Accounting Standards Update 2016-02, Leases (Topic 842), issued in February 2016, and International Accounting Standards Board's International Financial Reporting Standard No. 16, Leases, issued in January 2016.

Following are several key provisions to be aware of when considering the impact of the new lease accounting standard.

Classification and Measurement

To qualify as a lease under the new standard, a contract must “convey control of the right to use another entity’s nonfinancial asset for a period of time in an exchange or exchange-like transaction,” as stated in Statement No. 87. Two exceptions to this rule:

- Short-term leases (those with a maximum possible term of 12 months or less, including any extension options)

- Leases that transfer ownership of a leased asset at the end of the term

For short-term leases, lessees are required to recognize payments made as outflows of resources while lessors should recognize payments received as inflows of resources based on the payment provisions of the contract.

For contracts that transfer ownership of the leased asset at the end of the lease term and don’t contain a termination clause, lessees should record the contract as a financed purchase of an asset and lessors should record the sale of an asset.

Lessee

Upon commencement of a lease, which is the date the underlying asset is made available for use to the lessee, a lessee should recognize a lease liability and an intangible right-to-use lease asset:

- Lease liability is initially measured at the present value of the lease payments, as described in the standard, over the lease term.

- Lease asset is initially measured as the total of the initial lease liability; lease payments made to the lessor at or before the commencement date, net of any lease incentives received from the lessor; and initial direct costs to place the lease asset into service.

The subsequent measurement of the lease liability and lease asset is similar to existing standards for capital leases:

- Lease liability is increased for interest accrual and reduced when lease payments are made.

- Lease asset is amortized on a systematic and rational basis over the shorter of the lease term or the lease asset’s estimated useful life.

A lessee’s lease asset is subject to existing impairment guidance in GASB Statement No. 42, Accounting and Financial Reporting for Impairment of Capital Assets and for Insurance Recoveries.

Lessor

Unless an underlying lease asset is reported as an investment measured at fair value in accordance with GASB Statement No. 72, Fair Value Measurement and Application—in which case, Statement No. 87 doesn’t apply—or the lease is subject to external laws, regulations, or legal rulings that meet certain conditions contained in the standard, a lessor is required to recognize a lease receivable and a deferred inflow of resources upon the commencement date of the lease:

- Lease receivable is initially measured using the present value of the lease payments over the lease term, reduced by any provision for estimated uncollectible amounts.

- Deferred inflow of resources is measured at the amount of the initial measurement of the lease receivable, plus any payments received at or before the commencement date that relate to future periods, less any incentives paid. A lessor records an inflow of resources—interest revenue, for example—on a systematic and rational basis over the lease term.

A lessor isn’t allowed to derecognize an underlying asset in any case.

Other Key Provisions

Lease Term

Included in the lease term is the noncancelable portion of the lease plus those periods the lessee and lessor are reasonably certain will remain in the lease. This includes:

- Periods the lessee or lessor is able to extend to the lease and is reasonably certain to do

- Periods when the lessee or lessor is able to but is reasonably certain not to terminate the lease

If the lease term changes, a lessee remeasures the lease liability using revised inputs at the reassessment date and adjusts the lease asset accordingly. However, if the lease asset is reduced to zero, a lessee recognizes any remaining amount in the resource flows statement—a gain, for example—in the period in which the lease term is reassessed. Similarly, a lessor remeasures the lease receivable and adjusts the deferred inflow of resources accordingly.

Lease Modifications

Upon the occurrence of specified events, such as a change in the lease term or certain other lease modifications:

- Lessees must remeasure the lease liability and adjust the lease asset accordingly.

- Lessors are required to remeasure the lease receivable and adjust the deferred inflow of resources accordingly.

For a lessee, remeasurement is also triggered when there’s a change in whether the lessee is reasonably certain to exercise a purchase option or a change in the estimated payments already included in the lease liability, other than indexed or rate-based variable lease payments. If the lease asset is reduced to zero, a lessee recognizes any remaining amount as a gain in the period in which the lease liability is reassessed.

For a lessor, remeasurement is also triggered when there’s a change in the interest rate charged to the lessee or a contingency that converts nonindexed and non-rate-based variable payments to a payment type listed in the section on lease payments below.

Additional Underlying Assets

A lease modification that adds one or more underlying assets and includes a commensurate increase in lease payments should be accounted for as a separate lease rather than remeasuring the lease liability—or lease receivable, for a lessor.

Underlying Asset Reduction

A lease modification that reduces the underlying assets or lease term should be accounted for as a partial or full lease termination by reducing the carrying values of the lease asset and lease liability—or lease receivable and deferred inflow of resources, for a lessor—and recognizing a gain or loss for the difference.

Lease Payments

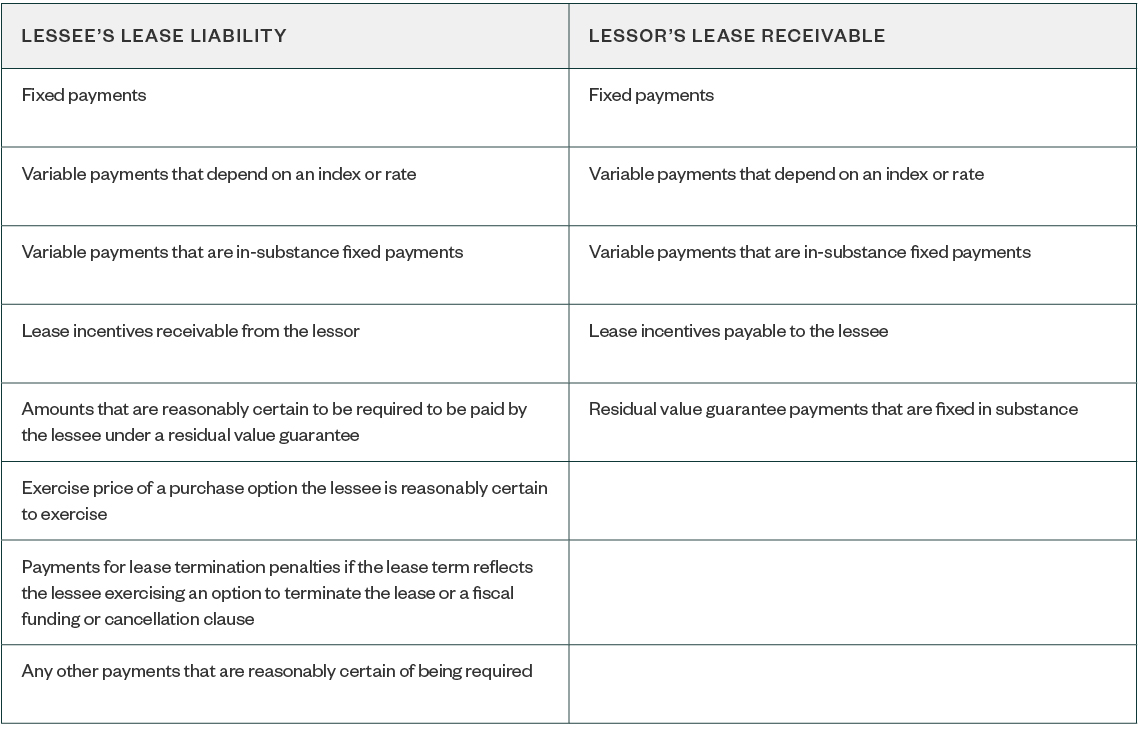

At the lease commencement date, the lease payments included in a lessee’s calculation of its lease liability and a lessor’s calculation of its lease receivable should consist of those outlined in Statement No. 87 and included in the table below.

The lessee or lessor should reassess variable lease payments that depend on an index or a rate only when the lease liability or lease receivable is reassessed for other reasons as discussed above. Accordingly, reassessment isn’t required solely because of changes to the index or rate.

A lessor should recognize payments for the exercise of a purchase option and lease termination penalties upon exercise.

Discount Rate

The discount rate used in a lessee’s calculation of its lease liability and a lessor’s calculation of its lease receivable should be the rate charged by the lessor. When a lessee can’t determine that rate, the lessee should use its incremental borrowing rate. Discount rates should only be reassessed in the following instances:

- Lessee. Upon a change in the lease term or a change in determination as to whether the lessee is reasonably certain to exercise a purchase option.

- Lessor. Upon a change in lease term or a change in interest rate charged to the lessee.

If there’s a change in the discount rate, a lessee’s lease asset and lease liability or a lessor’s lease receivable and deferred inflow of resources are adjusted using the revised discount rate in the period of change. The new rate is then used on a prospective basis.

Contracts with Multiple Components

A government should generally account for contracts with lease and nonlease components, such as common area maintenance services, as separate contracts. If a lease contains multiple underlying assets with different lease terms or in different major classes of assets, each underlying asset should be accounted for as a separate lease contract.

Contract price should be allocated to each component based on the prices for the individual components included in the contract, as long as the price allocation isn’t unreasonable. If the contract doesn’t include individual prices or the prices are unreasonable, contract price should be allocated using a best estimate, maximizing the use of observable information. If this isn’t practicable, the components should be accounted for as a single lease component based on the terms of the primary lease component within the contract.

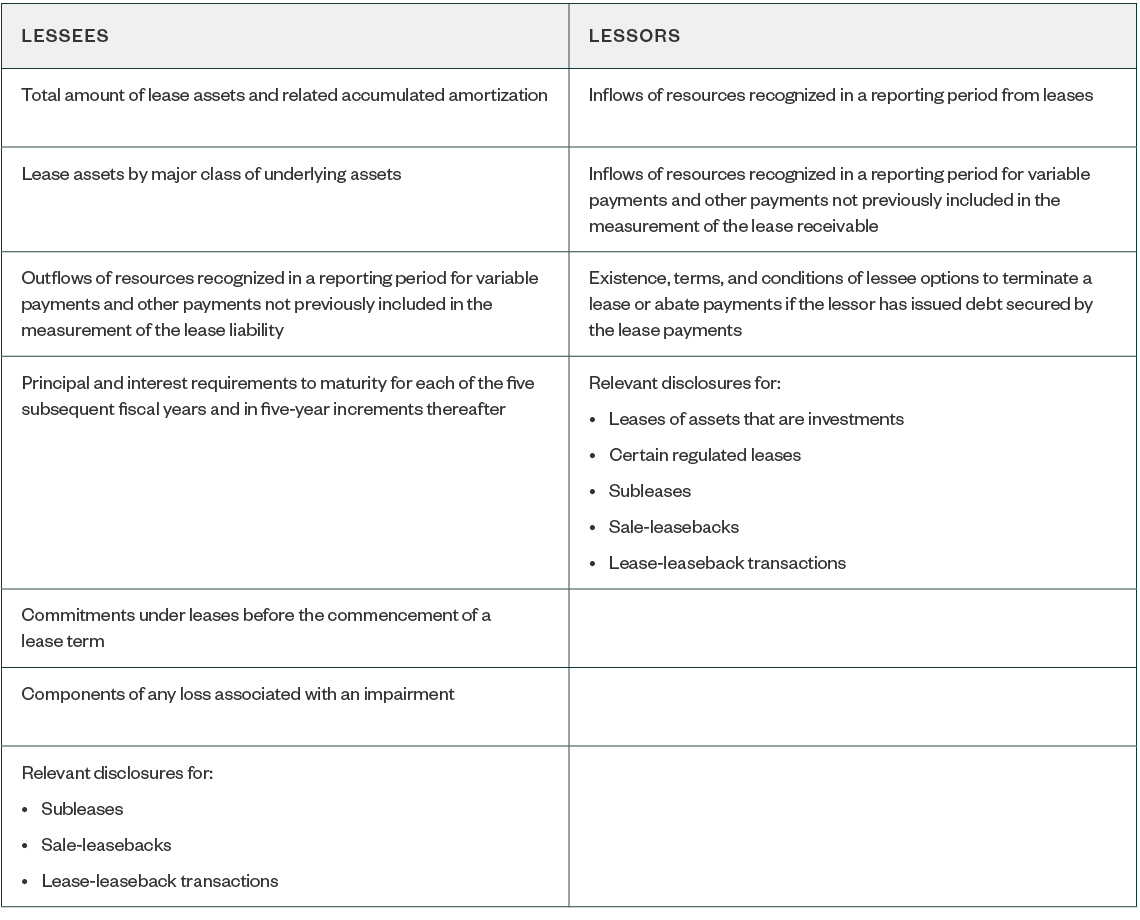

Disclosures

Lessees and lessors are both required to provide a general description of their leasing arrangement. They’re also obligated to disclose additional items, as written in Statement No. 87 and shown in the table below.

Transition and Effective Dates

The requirements of Statement No. 87 are effective for reporting periods beginning after December 15, 2019, but earlier application is encouraged.

If practicable, the requirements should be applied retroactively by restating financial statements for all prior periods presented. Leases should be recognized and measured using the facts and circumstances that existed at the lease commencement date or the beginning of the earliest period restated, whichever occurred later.

We're Here to Help

For any questions or to better understand how this new standard may affect your government organization, contact your Moss Adams professional.